FIRAN TECHNOLOGY GROUP CORPORATION (“FTG”) ANNOUNCES SECOND QUARTER 2021 FINANCIAL RESULTS

FIRAN TECHNOLOGY GROUP CORPORATION (“FTG”) ANNOUNCES SECOND QUARTER 2021 FINANCIAL RESULTS

FIRAN TECHNOLOGY GROUP CORPORATION (“FTG”) ANNOUNCES SECOND QUARTER 2021 FINANCIAL RESULTS

TORONTO, ONTARIO – (July 14, 2021) – Firan Technology Group Corporation (TSX: FTG) today announced financial results for the second quarter 2021.

- FTG achieved a second sequential quarter of increased bookings as the aerospace industry recovers from the COVID-19 pandemic.

- Second quarter bookings are up 8% over Q1 2021 and up 20% over Q4 2020.

- Gross margins rebounded 7.2 percentage points over Q1 2021 to 26.8% with increased revenues andstronger operating performance, demonstrating the operating leverage that results from increased sales.

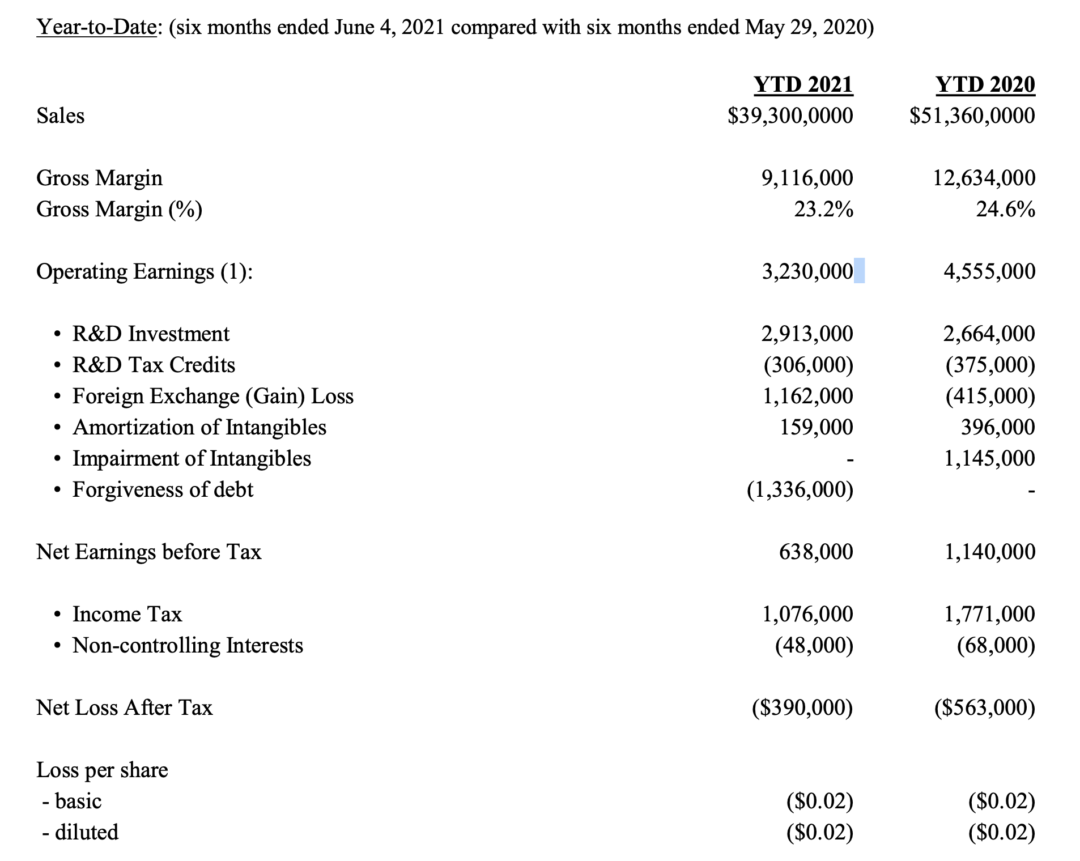

- FTG increased net cash on the balance sheet to $14.8M, an increase of $1.4M in Q2 2021 again showing the cash generating nature of the business. Over the past 18 months, during the pandemic, FTG hasgenerated $13M in Free Cash Flow, after investments in R&D and capital equipment.

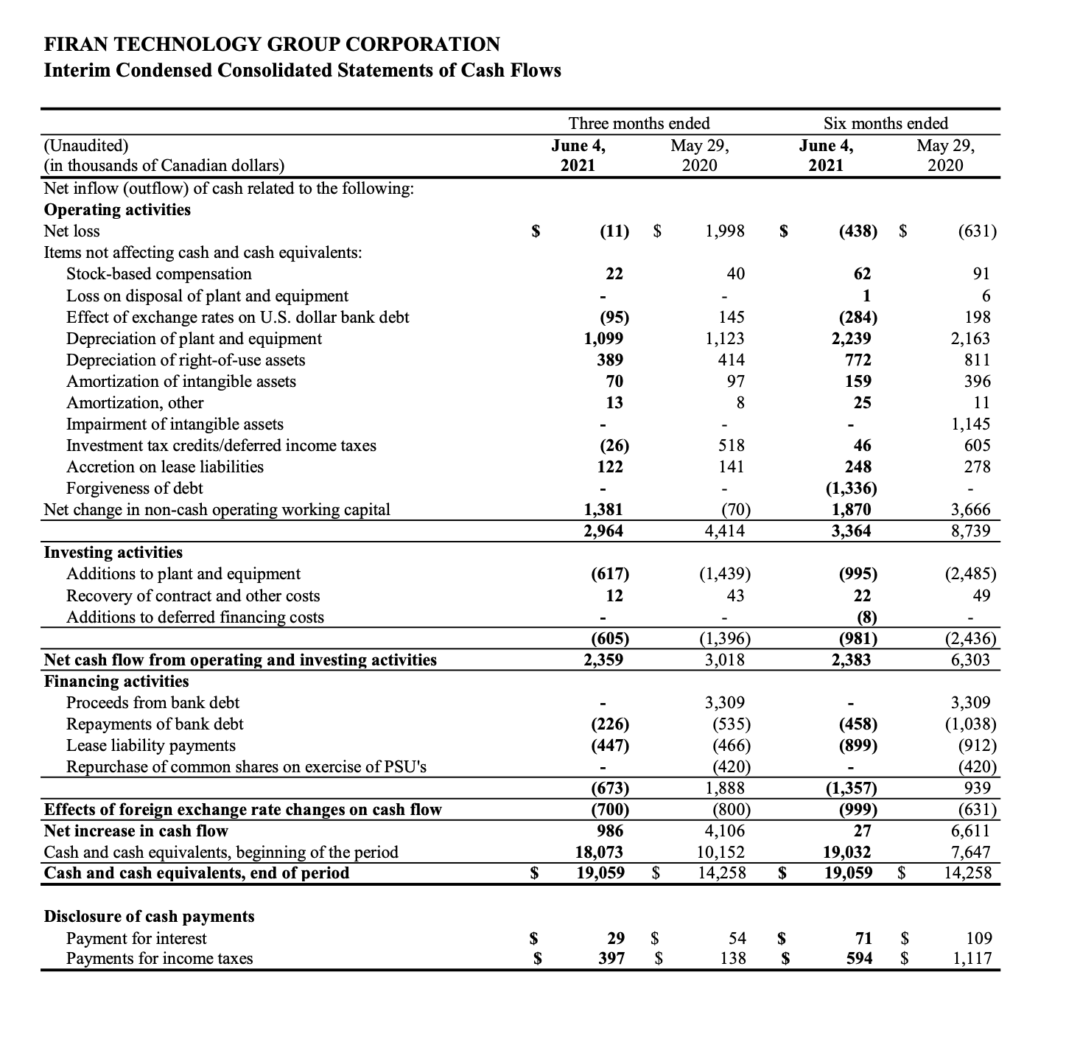

- FTG was approved for an additional $1.2M in Canada Emergency Wage Subsidy (CEWS) in the quarterwhich we used to help maintain our workforce in the face of revenue reductions due to COVID-19. Second Quarter Results: (three months ended June 4, 2021 compared with three months ended May 29, 2020)

(1) Operating Earnings is not a measure recognized under International Financial Reporting Standards (“IFRS”). Management believes that this measure is important to many of the Corporation’s shareholders, creditors and other stakeholders. The Corporation’s method of calculating Operating Earnings may differ from other corporations and accordingly may not be comparable to measures used by other corporations.

Business Highlights

FTG accomplished many goals in Q2 2021 that continue to improve the Corporation and position it for the future, including:

- Achieved a 0.97:1 book-to-bill ratio for Q2 2021. Increased bookings by 8% compared to Q1 2021, and by 20% compared to Q4 2020 as the Commercial aerospace industry begins to recover.

- Was approved for an additional $1.2M in Canada Emergency Wage Subsidy (CEWS) which we used to help maintain our workforce in the face of revenue reductions due to COVID-19.

- Subsequent to the end of Q2, FTG received forgiveness of USD 1.3M, being the residual of US Paycheck Protection Program funds received by our U.S. operations as a result of FTG maintaining our workforce for the required period of time. This amount will be included in income for Q3 2021.

- FTG Aerospace Chatsworth, which maintained an engineering office in Dallas-Fort Worth since the acquisition of Photo-Etch in 2016, will close this office by the end of 2021 and move the function to the Chatsworth site in California reducing the site’s facility costs in 2022 and beyond.

Press Release 21-007

Received significant new bid and qualification opportunities for both businesses that are expected to benefit FTG revenues and market share in the coming quarters;

- Repatriation efforts to re-shore some circuits board sourcing to North America.

- New Aerospace opportunities for circuit board sourcing from low cost countries (China).

- Opportunities to participate in the new US trainer aircraft cockpit.

- Increased awards for circuit boards on a contract renewal from a US Tier 1 avionics manufacturer.

- New qualification opportunities for circuit boards for a major US headquartered EMS provider.

- New opportunities for space applications for circuit boards and shipped first flight cockpit panels for manned-space vehicle within the quarter.

- Large new circuit board and assembly opportunity from a large US Defense contractor.

- A number of new US military aftermarket assembly opportunities for multi-year procurements.

- The Averatek semi-additive circuit board manufacturing equipment in our Circuits Fredericksburg facility completed installation and was operational in Q2. Activities have been initiated with over 10 customers to develop this process to address future industry demands.

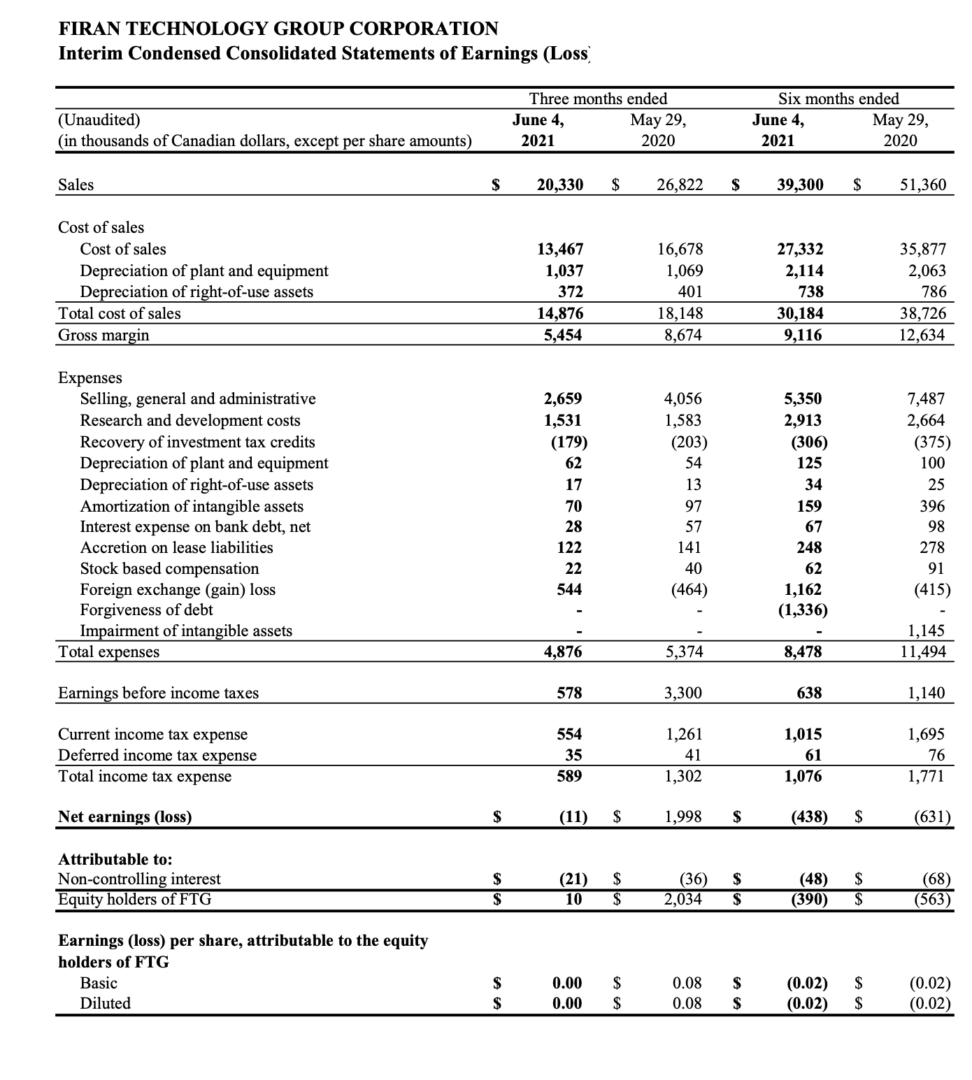

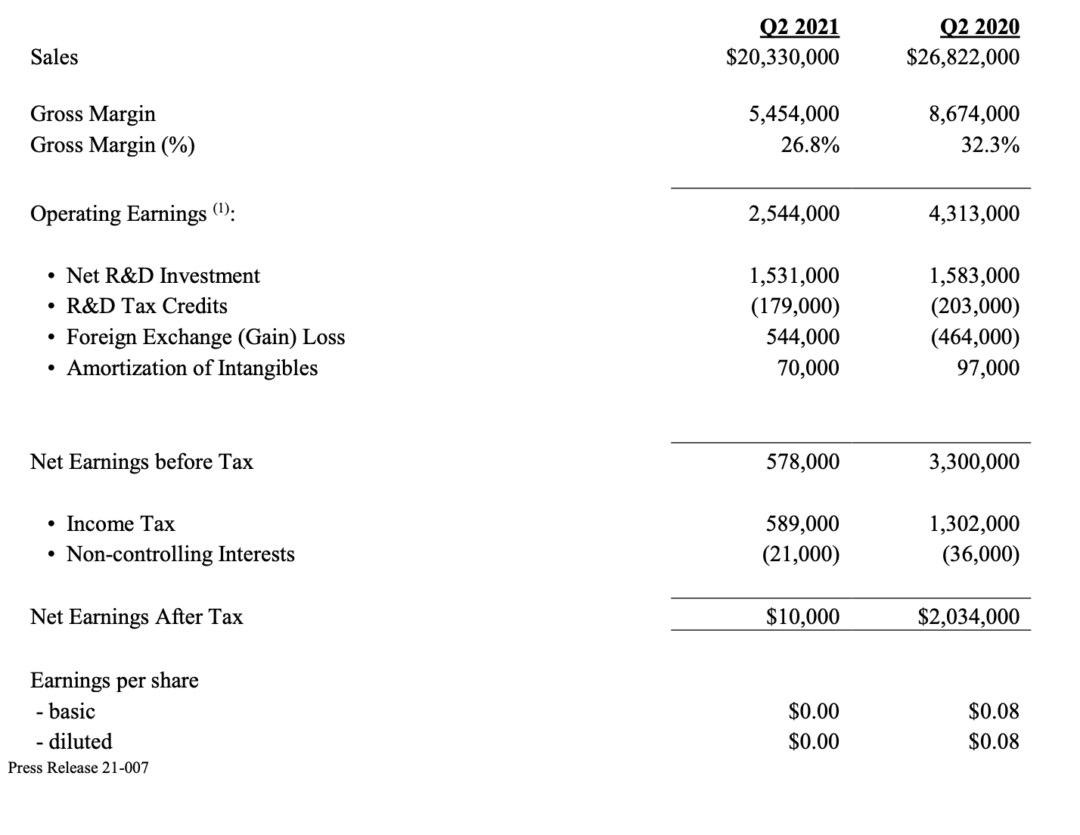

Overall for FTG, sales decreased by $6.5M or 24% from $26.8M in Q2 2020 to $20.3M in Q2 2021. The COVID- 19 pandemic has negatively impacted commercial aerospace activity as well as the weaker US dollar has negatively impacted sales reported in Canadian currency. The average exchange rate for Q2 2021 was $1.24 as compared to $1.40 for Q2 2020, which is a decline of 11%. This represents approximately a $2.5M negative impact on sales in the quarter compared to Q2 last year. On a year-to-date basis, sales were $39.3M as compared to $51.4M in 2020. The decrease is due to the COVID-19 pandemic impact on commercial aerospace activity as well as the currency impact. The average exchange rate for the year-to-date period in 2021 was $1.26 as compared to $1.36 in the comparable prior year period.

On a sequential basis, sales increased from $19.0M in Q1 2021 to $20.3M in Q2 2021, with the gradual recovery of commercial aerospace shipments taking hold, as well as fewer COVID-19 issues within our operating sites.

The Circuits Segment net sales in Q2 2021 were down $6.6M, or 35% in Q2 2021 versus Q2 2020. All sites were down but the largest decline was seen in the Circuits Toronto plant which is more heavily exposed to the Commercial Aerospace market. On a year-to-date basis, net sales were $25.0 as compared to $36.1M for the prior year period.

For the Aerospace Segment, net sales in Q2 2021 were $7.3M compared to $7.2M in Q2 last year, an increase of $0.1M or 2%. Increased shipments to military customers from our Chatsworth, CA site exceeded the combined impact of the downturn in the commercial aerospace market, reduced Simulator related sales and the currency impact. The Aerospace Tianjin site was down as it is exclusively focused on commercial aerospace. On a year- to-date basis, net sales were $14.3M as compared to $15.3M for the prior year period.

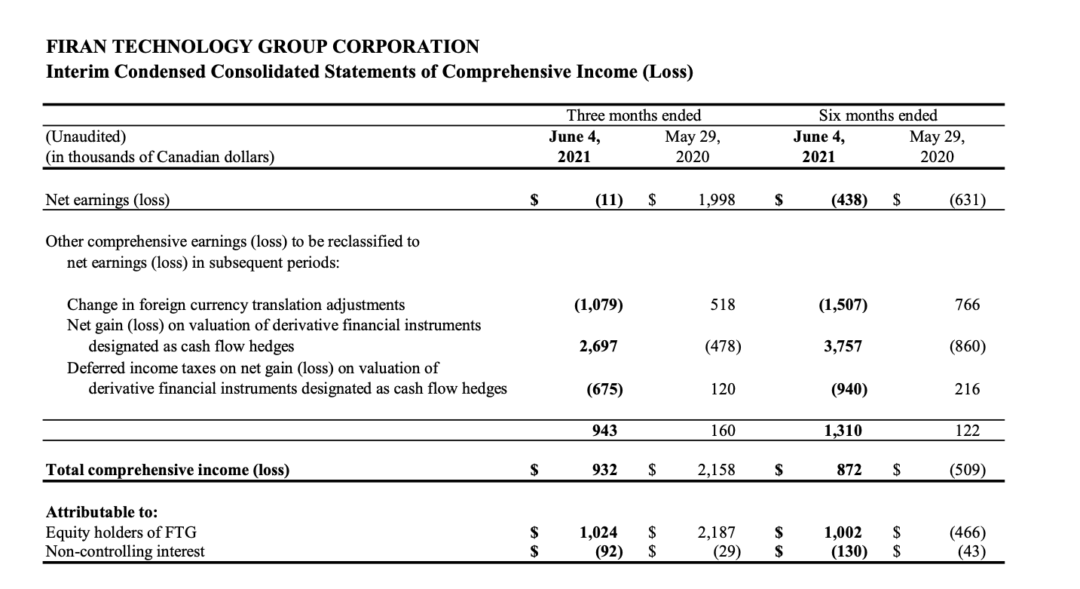

Gross margins in Q2 2021 were $5.5M or 26.8% compared to $8.7M or 32.3% in Q2 2020. The lower sales impacted the overall margin. The CEWS added $1.2M to gross margin or 5.8 percentage points (Q2 2020 – $0.8M or 3.0 percentage points). On a year-to-date basis, gross margin was $9.1M or 23.2% as compared to $12.6M or 24.6% for the comparable prior year period. The decline in gross margin is due to the lower level of sales, partially offset by CEWS of $2.2M in 2021 as compared to $0.8M in 2020.

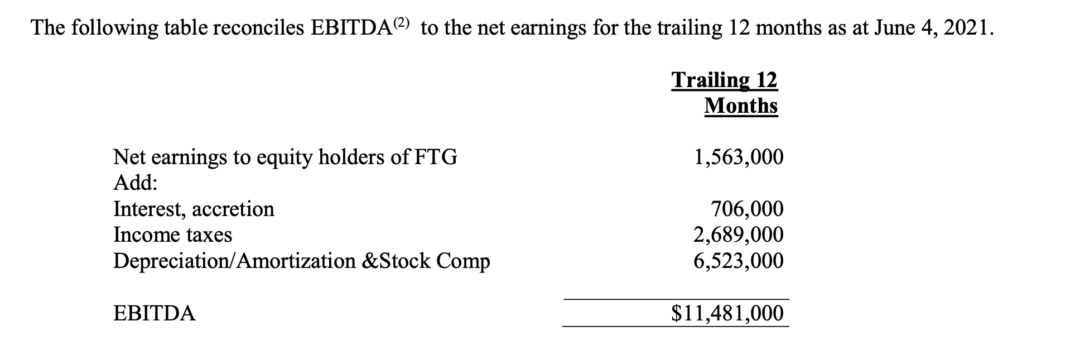

Trailing Twelve Month (TTM) Earnings before interest, tax, depreciation and amortization (EBITDA) for FTG was $11.5M. Lower sales, unfavourable foreign exchange impact and some operational challenges in Circuits Chatsworth, were partially offset by wage subsidies in Canada and the PPP forgiveness in the US.

Press Release 21-007

(2) EBITDA are not measures recognized under International Financial Reporting Standards (“IFRS”). Management believes that these measures are important to many of the Corporation’s shareholders, creditors and other stakeholders. The Corporation’s method of calculating EBITDA may differ from other corporations and accordingly may not be comparable to measures used by other corporations.

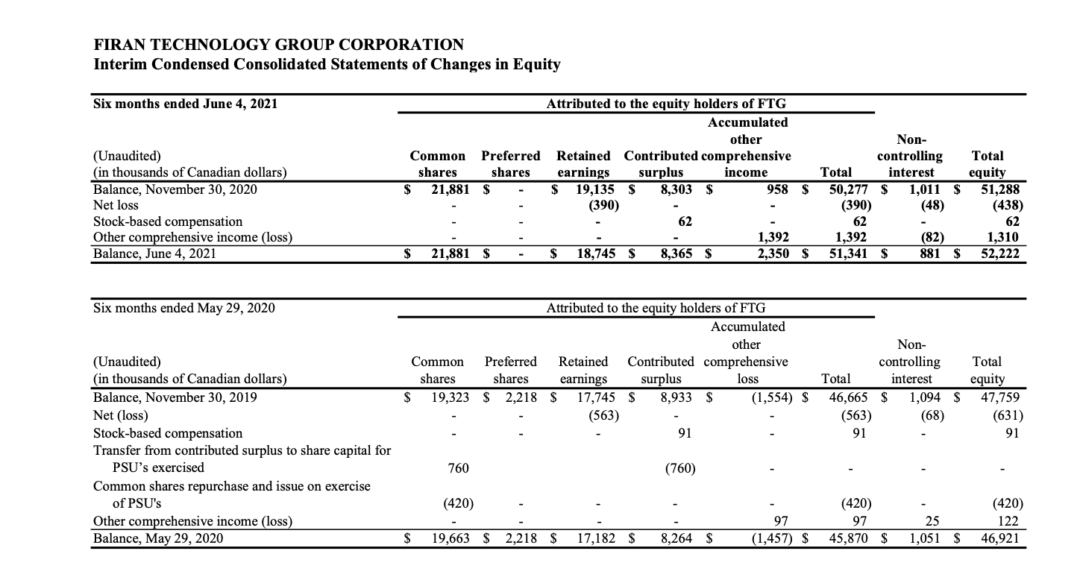

Net earnings after tax at FTG in Q2 2021 was $0.0M or $0.00 per diluted share compared to $2.0M or $0.08 per diluted share in Q2 2020. Revenues were reduced due to the decline in the Commercial Aerospace market as a result of the COVID-19 pandemic and the weaker US dollar. In Q2 2021, the average FX rate was 1.24 as compared to 1.40 in Q2 2020. For the year-to-date period, FTG incurred a net loss of $0.4M or $0.02 per share as compared to a net loss of $0.6M or $0.02 per share for the comparable period of 2020. Apart from the reduction in sales, the 2021 year-to-date period included $1.3M of debt forgiveness, whereas the prior year period included $1.1M of impairment of intangible assets.

The Circuits Segment net earnings before corporate and interest and other costs was $1.1M in Q2 2021 compared to $3.8M in Q2 2020. The lower sales was the most significant impact on the segment profitability. The stronger Canadian dollar also hurt results as did some operational challenges such as the Circuits Toronto site being designated a COVID hotspot in the quarter, the impact of paid sick days being introduced in Ontario and some ongoing production challenges in the Chatsworth site.

The Aerospace net earnings before corporate and interest and other costs decreased to $0.4M in Q2 2021 from $0.6M in Q2 2020. Segment profitability was negatively impacted by the weaker US dollar.

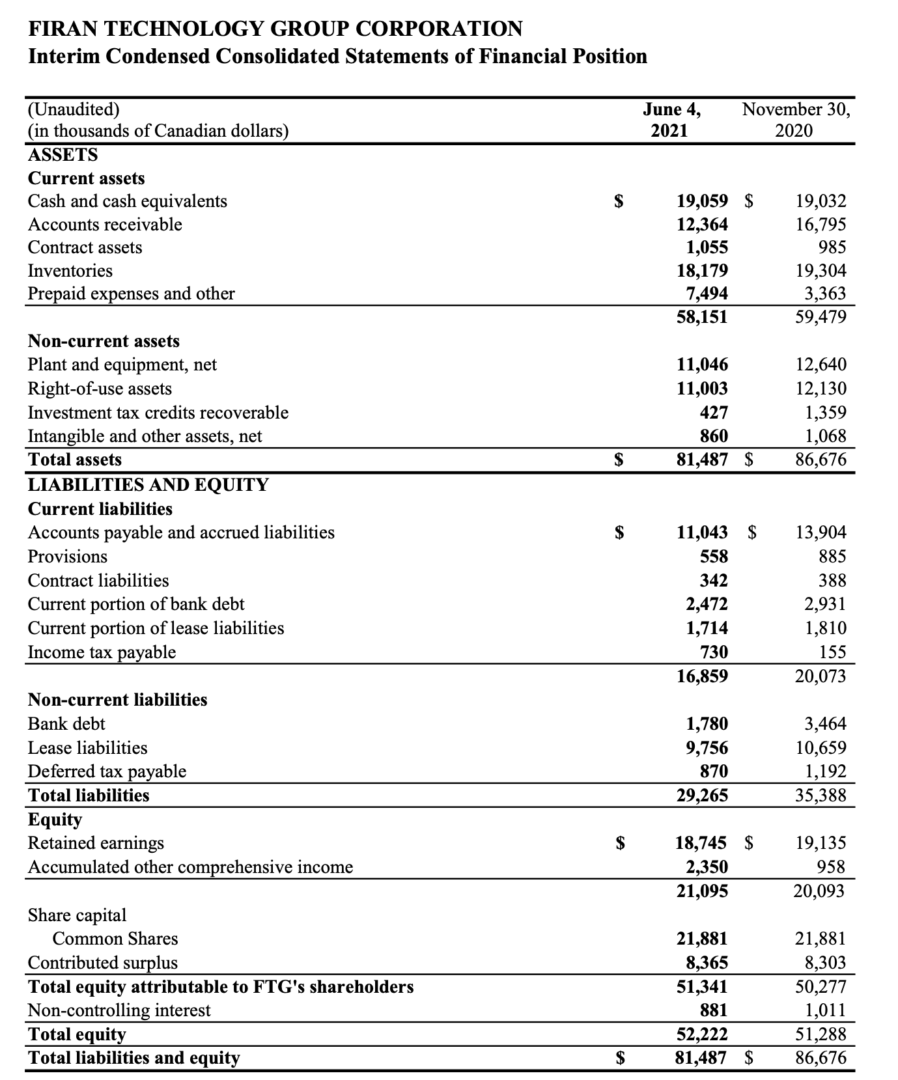

As at June 4, 2021, the Corporation’s net working capital was $41.3M, compared to $39.4M at year-end in 2020.

FTG ended Q2 2021 with $14.8M in net cash as compared to $12.6M at the end of 2020, and $13.4M at the end of the first quarter 2021.

Subsequent to Q2 2021, the Corporation reached an agreement with its primary lender to extend the Corporation’s credit facilities to July 2026.

The Corporation will host a live conference call on Thursday, July 15, 2021 at 8:30am (Eastern) to discuss the results of the second quarter 2021.

Anyone wishing to participate in the call should dial 647-427-2311 or 1-866-521-4909 and identify that you are calling to participate in the FTG conference call. The Chairperson is Mr. Brad Bourne. A replay of the call will be available until August 15, 2021 and will be available on the FTG website at www.ftgcorp.com. The number to call for a rebroadcast is 416-621-4642 or 1-800-585-8367, Conference ID 1169927.

Press Release 21-007

ABOUT FIRAN TECHNOLOGY GROUP CORPORATION

FTG is an aerospace and defense electronics product and subsystem supplier to customers around the globe. FTG has two operating units:

FTG Circuits is a manufacturer of high technology, high reliability printed circuit boards. Our customers are leaders in the aviation, defense, and high technology industries. FTG Circuits has operations in Toronto, Ontario, Chatsworth, California, Fredericksburg, Virginia and a joint venture in Tianjin, China.

FTG Aerospace manufactures and repairs illuminated cockpit panels, keyboards and sub-assemblies for original equipment manufacturers of aerospace and defense equipment. FTG Aerospace has operations in Toronto, Ontario, Chatsworth, California, Fort Worth, Texas and Tianjin, China.

The Corporation’s shares are traded on the Toronto Stock Exchange under the symbol FTG.

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements. These forward-looking statements are related to, but not limited to, FTG’s operations, anticipated financial performance, business prospects and strategies. Forward-looking information typically contains words such as “anticipate”, “believe”, “expect”, “plan” or similar words suggesting future outcomes. Such statements are based on the current expectations of management of the Corporation and inherently involve numerous risks and uncertainties, known and unknown, including economic factors and the Corporation’s industry, generally. The preceding list is not exhaustive of all possible factors. Such forward-looking statements are not guarantees of future performance and actual events and results could differ materially from those expressed or implied by forward-looking statements made by the Corporation. The reader is cautioned to consider these and other factors carefully when making decisions with respect to the Corporation and not place undue reliance on forward-looking statements. Other than as may be required by law, FTG disclaims any intention or obligation to update or revise any such forward-looking statements, whether as a result of new information, future events or otherwise.

For further information please contact:

Bradley C. Bourne, President and CEO

Firan Technology Group Corporation

Tel: (416) 299-4000 x314

bradbourne@ftgcorp.com

Jamie Crichton, Vice President and CFO

Firan Technology Group Corporation

Tel:(416) 299-4000 x264

jamiecrichton@ftgcorp.com

Additional information can be found at the Corporation’s website www.ftgcorp.com